Unused Supplies Debit Or Credit . For example, if you used $220 in supplies, debit the supplies expense for $220. The debit to supplies expense account is necessary. The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. The debit entry reflects the supplies expense. Balance the entry by crediting your supplies account. Some organizations, under the accrual basis of accounting, record unused factory supplies in an asset account, such as supplies on hand, and then charge the. Supplies are incidental items used during the course of production, or as part of an organization’s administrative activities. Why do we debit supplies expense account instead of crediting cash?

from www.chegg.com

The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. Why do we debit supplies expense account instead of crediting cash? The debit to supplies expense account is necessary. Balance the entry by crediting your supplies account. The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. Some organizations, under the accrual basis of accounting, record unused factory supplies in an asset account, such as supplies on hand, and then charge the. Supplies are incidental items used during the course of production, or as part of an organization’s administrative activities. For example, if you used $220 in supplies, debit the supplies expense for $220. The debit entry reflects the supplies expense.

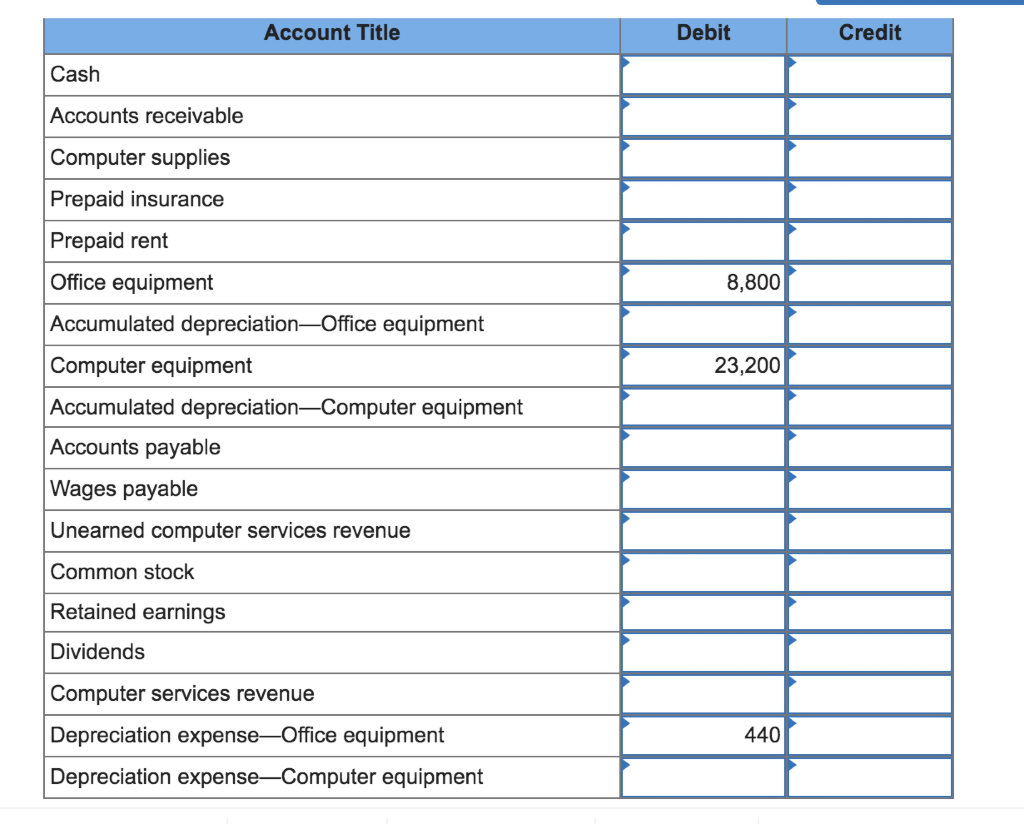

Solved Account Title Debit Credit Cash Accounts receivable

Unused Supplies Debit Or Credit The debit to supplies expense account is necessary. The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. For example, if you used $220 in supplies, debit the supplies expense for $220. The debit to supplies expense account is necessary. The debit entry reflects the supplies expense. Balance the entry by crediting your supplies account. Some organizations, under the accrual basis of accounting, record unused factory supplies in an asset account, such as supplies on hand, and then charge the. Supplies are incidental items used during the course of production, or as part of an organization’s administrative activities. Why do we debit supplies expense account instead of crediting cash? The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense.

From www.patriotsoftware.com

Accounting Basics Debits and Credits Unused Supplies Debit Or Credit The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. For example, if you used $220 in supplies, debit the supplies expense for $220. Why do we debit supplies expense account instead of crediting cash? Some organizations, under the accrual basis of accounting, record unused factory supplies in. Unused Supplies Debit Or Credit.

From zuoti.pro

Part A. Requirement 3 After posting all transactions, please calculate Unused Supplies Debit Or Credit Why do we debit supplies expense account instead of crediting cash? The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. The debit entry reflects the supplies expense. The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. For example,. Unused Supplies Debit Or Credit.

From www.chegg.com

Solved Date General Journal Debit Credit Mar 01 Cash 160,000 Unused Supplies Debit Or Credit Why do we debit supplies expense account instead of crediting cash? Some organizations, under the accrual basis of accounting, record unused factory supplies in an asset account, such as supplies on hand, and then charge the. The debit to supplies expense account is necessary. The debit entry reflects the supplies expense. The cost of the office supplies used up during. Unused Supplies Debit Or Credit.

From www.chegg.com

Solved E41 (Static) Explaining Why Adjustments Are Needed Unused Supplies Debit Or Credit Balance the entry by crediting your supplies account. Supplies are incidental items used during the course of production, or as part of an organization’s administrative activities. For example, if you used $220 in supplies, debit the supplies expense for $220. The debit to supplies expense account is necessary. The debit entry reflects the supplies expense. The cost of the office. Unused Supplies Debit Or Credit.

From www.chegg.com

Solved Debit Credit Cash Accounts Receivable Supplies Unused Supplies Debit Or Credit The debit to supplies expense account is necessary. Balance the entry by crediting your supplies account. Some organizations, under the accrual basis of accounting, record unused factory supplies in an asset account, such as supplies on hand, and then charge the. The cost of the office supplies used up during the accounting period should be recorded in the income statement. Unused Supplies Debit Or Credit.

From www.badcredit.org

What Should You Do with Unused Credit Cards? Unused Supplies Debit Or Credit Balance the entry by crediting your supplies account. The debit to supplies expense account is necessary. The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. For example, if you used $220 in supplies, debit the supplies expense for $220. Some organizations, under the accrual basis of accounting, record unused factory supplies. Unused Supplies Debit Or Credit.

From www.chegg.com

Solved Account Title Debit Credit Cash Accounts receivable Unused Supplies Debit Or Credit The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. Why do we debit supplies expense account instead of crediting cash? Balance the entry by crediting your supplies account. For example, if you used $220 in supplies, debit the supplies expense for $220. Some organizations, under the accrual basis of accounting, record. Unused Supplies Debit Or Credit.

From www.vrogue.co

Unadjusted Trial Balance Format Uses Steps And Exampl vrogue.co Unused Supplies Debit Or Credit The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. The debit entry reflects the supplies expense. Some organizations, under the accrual basis of accounting, record unused factory supplies in an asset account, such as supplies on hand, and then charge the. Supplies are incidental items used during. Unused Supplies Debit Or Credit.

From www.chegg.com

Solved Balance Account Title Debit Credit Cash 3,600 Unused Supplies Debit Or Credit The debit entry reflects the supplies expense. The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. The debit to supplies expense account is necessary. Some organizations, under the accrual basis of accounting, record unused factory supplies in an asset account, such as supplies on hand, and then. Unused Supplies Debit Or Credit.

From www.iconcmo.com

Debit and Credit Learn their meanings and which to use. Unused Supplies Debit Or Credit The debit to supplies expense account is necessary. Why do we debit supplies expense account instead of crediting cash? Supplies are incidental items used during the course of production, or as part of an organization’s administrative activities. The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. Balance. Unused Supplies Debit Or Credit.

From www.chegg.com

Solved Requirement 1. Journalize the adjusting entries using Unused Supplies Debit Or Credit For example, if you used $220 in supplies, debit the supplies expense for $220. The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. Supplies are incidental items used during the course of production, or as part of an organization’s administrative activities. Why do we debit supplies expense account instead of crediting. Unused Supplies Debit Or Credit.

From www.pinterest.com

Sell Your Unused Items to Pay Off Debt Debt payoff, Credit card debt Unused Supplies Debit Or Credit Some organizations, under the accrual basis of accounting, record unused factory supplies in an asset account, such as supplies on hand, and then charge the. The debit to supplies expense account is necessary. Supplies are incidental items used during the course of production, or as part of an organization’s administrative activities. Why do we debit supplies expense account instead of. Unused Supplies Debit Or Credit.

From www.chegg.com

Solved Debit Credit Cash Accounts Receivable Invento Unused Supplies Debit Or Credit The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. Balance the entry by crediting your supplies account. The debit to supplies expense account is necessary. The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. For example, if you. Unused Supplies Debit Or Credit.

From www.chegg.com

Solved Prior to recording adjusting entries, the Office Unused Supplies Debit Or Credit Balance the entry by crediting your supplies account. The debit entry reflects the supplies expense. For example, if you used $220 in supplies, debit the supplies expense for $220. Why do we debit supplies expense account instead of crediting cash? The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. The debit. Unused Supplies Debit Or Credit.

From www.chegg.com

Solved Prior to recording adjusting entries, the Office Unused Supplies Debit Or Credit Why do we debit supplies expense account instead of crediting cash? The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. Supplies are incidental items used during the course of production, or as part of an organization’s administrative activities. Balance the entry by crediting your supplies account. The. Unused Supplies Debit Or Credit.

From accountingqanda.blogspot.com

Accounting Questions and Answers PR 31A Adjusting entries Unused Supplies Debit Or Credit The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. Balance the entry by crediting your supplies account. Supplies are incidental items used during the course of production, or as part of an organization’s administrative activities. For example, if you used $220 in supplies, debit the supplies expense for $220. Some organizations,. Unused Supplies Debit Or Credit.

From fabalabse.com

What is debit and credit in account receivable? Leia aqui What is Unused Supplies Debit Or Credit The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. The debit to supplies expense account is necessary. Some organizations, under the accrual basis of accounting, record unused factory supplies in an asset account, such as supplies on hand, and then charge the. Supplies are incidental items used. Unused Supplies Debit Or Credit.

From www.myaccountingcourse.com

Unadjusted Trial Balance Format Preparation Example Unused Supplies Debit Or Credit The credit entry shows the reduction in the supplies on hand by the amount utilized during the period. Balance the entry by crediting your supplies account. For example, if you used $220 in supplies, debit the supplies expense for $220. Some organizations, under the accrual basis of accounting, record unused factory supplies in an asset account, such as supplies on. Unused Supplies Debit Or Credit.